Self-funded companies, compared to their fully-insured counterparts, have more opportunity to manage and reduce claims expense and therefore, overall healthcare costs. Here we’ll explain this opportunity using four charts, including the role network discounts play in managing claims spend.

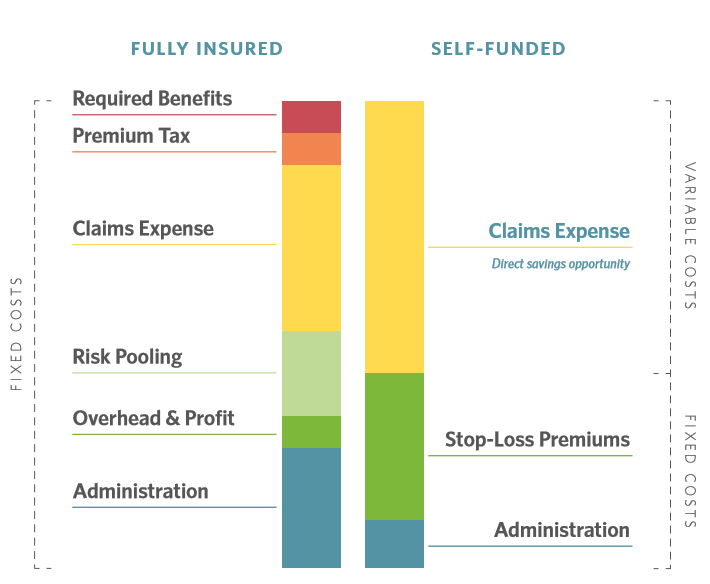

Fully-insured companies pay a pre-determined premium to cover healthcare costs for their workforce. Self-funded companies pay healthcare claims as they actually occur, affording them fewer fixed costs and more opportunity to manage overall claims expense. In the chart below, the claims expense category is labeled as “direct savings opportunity”. Depending on company size, this direct savings opportunity can account for up to 80% of total healthcare spend.

Related: Learn more about the benefits of self-funding in our guide for mid-market leaders.

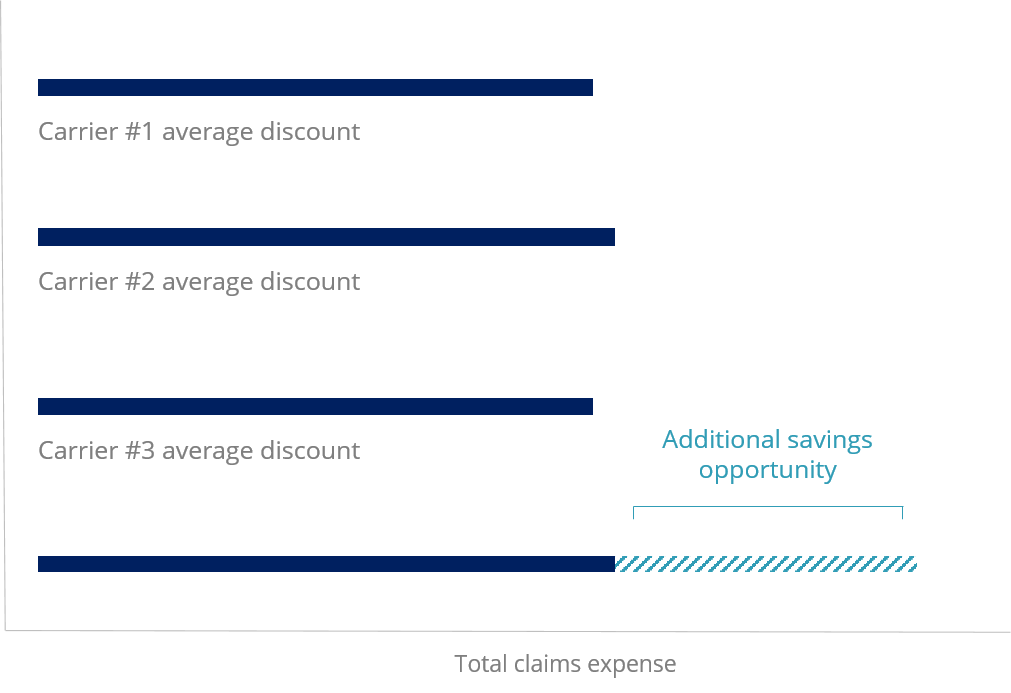

Most employers use a network discount negotiated by a carrier or TPA to help them save on claims cost. Typically these discounts hover around 50% between carriers, meaning that regardless of your carrier or TPA arrangement, most companies are accessing relatively the same discount on procedure costs.

Yet more savings opportunities exist beyond network discounts: Healthgram companies can realize up to 14% additional savings by turning attention to healthcare consumption.

Detailed review of high claims for eligibility, other coverage and duplication creates a strong foundation for claims management, but to access deeper savings, companies should focus on healthcare consumption by preventing unnecessary claims and encouraging utilization of the highest value facilities.

Just how much impact can smart utilization have on costs? Individual procedure costs vary significantly based on facility – sometimes up to 1000% within the same ZIP code for the same service. That cost variance impacts your claims expense: Even with a 50% discount, your plan and employees could easily overpay if the procedure is done at a high-cost facility.

This example is from the Charlotte, NC area, where costs for common procedures range an average of 921%. A knee arthroscopy can cost companies and employees anywhere from $1,993 to over $18,819, and it’s hard to know where your claim will fall on the scale until you get the bill.

A cost variance of 944% for knee surgery is significant, but it’s not an isolated case. Many common procedures including imaging vary in cost within the same ZIP code, meaning you could have hundreds of these procedures charged to your plan each year. For some companies, costs for these common procedures can make up to 11% of total claims spend.

Below, see the price variance for ten common procedures in the Charlotte, NC area. Employee advocacy or guidance can help maximize utilization of low and fair price facilities, minimizing out-of-pocket costs for employees and controlling overall claims expense.

Self-funded companies have more opportunities to manage claims cost, but a network discount alone won’t deliver meaningful savings. Proactive intervention, utilization of highest-value facilities and detailed claims oversight can help companies access deeper savings.

Healthgram companies achieve an average of 14% additional savings beyond network discounts through smarter management of healthcare consumption. See how we can help you.