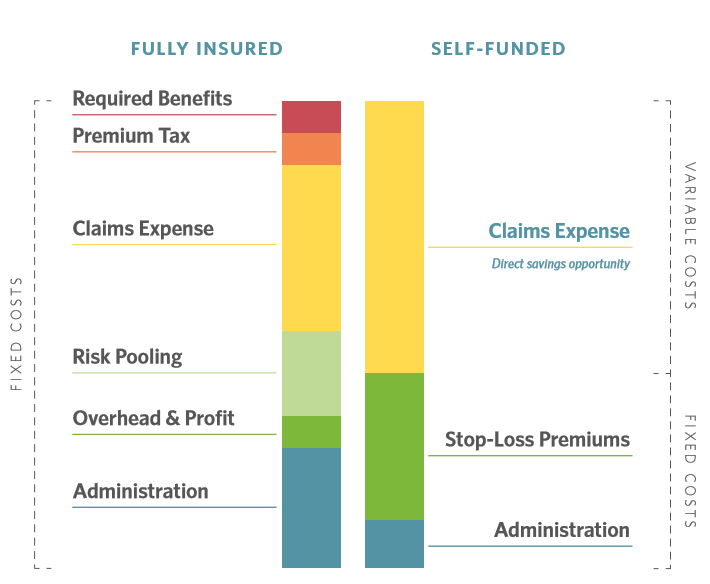

Self-funded companies, compared to their fully-insured counterparts, have more opportunity to manage and reduce variable claims expense and therefore, overall healthcare costs. Here we’ll explain this opportunity using four charts, including the role network discounts play in managing claims spend.

Rather than paying a pre-determined premium, self-funded companies pay healthcare claims as they actually occur. These companies have fewer fixed costs and more ability to control variable costs, or claims expense.

This gives them the opportunity, and incentive, to reduce the cost of claims expense. In the chart below, the claims expense category is labeled as “direct savings opportunity”.

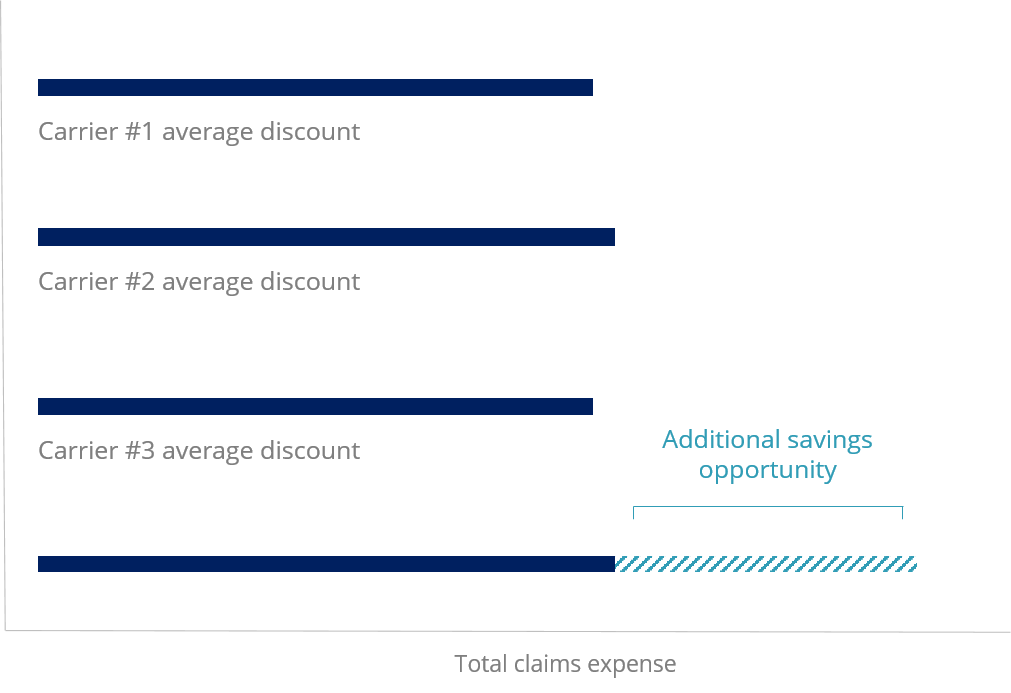

Most employers use a network discount negotiated by a carrier or TPA to help them save on claims cost. Typically these discounts hover around 50% between carriers. Meaning that regardless of your carrier or TPA arrangement, most companies are accessing relatively the same discount on procedure costs.

Yet more savings opportunities exist beyond network discounts: Some companies realize up to 14% additional savings.

Detailed review of high claims for eligibility, other coverage and duplication create a strong foundation, but to access deeper savings, companies and their health plan partners must integrate clinical intervention that prevents claims and encourages utilization of the highest value facilities.

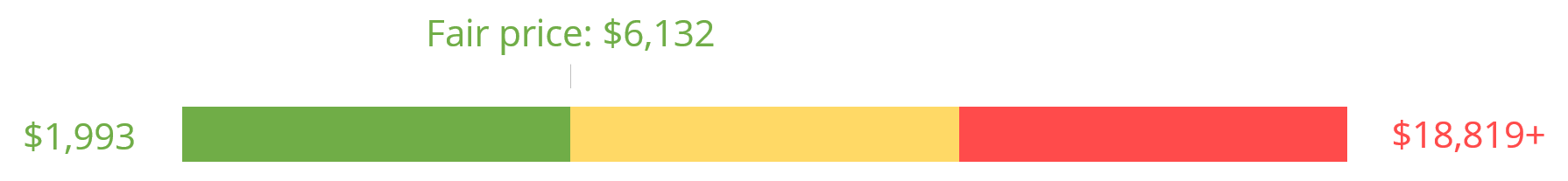

Just how much impact can smart utilization have on costs? Procedure costs vary widely based on facility – sometimes up to 1000% within the same ZIP code for the same service. That cost variance matters to self-funded employers and their employees: Even with a 50% discount, your plan and employees could overpay for common procedures, impacting your claims expense.

This example is from the Charlotte, NC area, where costs for common procedures range an average of 921%. An abdominal CT scan can cost companies and employees anywhere from $394 to over $3,800, and it’s hard to know where your claim will fall on the scale until you get the bill.

A cost variance of 944% for knee surgery is bad enough, but it’s not an isolated case. Many common procedures including imaging vary in cost within the same ZIP code, meaning you could have hundreds of these procedures charged to your plan each year. For some companies, costs for these common procedures can make up to 11% of total claims spend.

Below, see the price variance for ten common procedures in the Charlotte, NC area. Employee advocacy or guidance can help maximize utilization of low and fair price facilities, minimizing out-of-pocket costs for employees and controlling overall claims expense.

Self-funded companies have more opportunities to manage claims expense, but a network discount alone won’t deliver meaningful savings. Proactive intervention and utilization of highest-value facilities helps employers save on the most common procedures being charged to their plans, helping companies better manage claims expense.