A change in health plans affects everyone: employees, human resources, consultants and executive teams. But with the right partners and strategy in place, everyone can benefit. Follow these best practices to build smarter self-funded health plans around what’s most important to your key stakeholders.

Healthcare is typically the second largest expense for a business. Ensure your company can continue providing benefits that attract and retain talent by requiring:

When benefits are confusing or disruptive, employees look to HR for help. In our ongoing member survey, 52% of employees say that if they didn’t have access to Healthgram advisor, they would have involved HR. 39% would have avoided resolving their issue altogether. A better healthcare experience for HR should include:

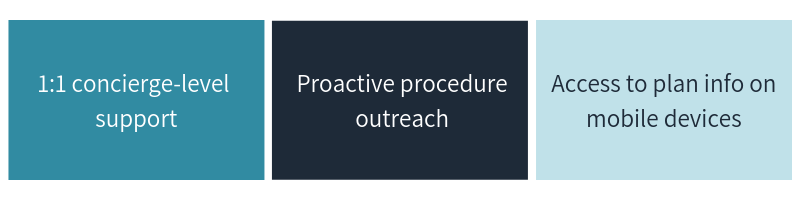

Smart benefits lead to savings and employer loyalty. Provide employees with a benefits experience that includes:

Companies rely closely on the expertise of their benefits adviser or broker. A successful health plan partner will provide them with: